Our clients always ask for Advice to discover their future and to predict suitable action required to plan for the best outcomes.

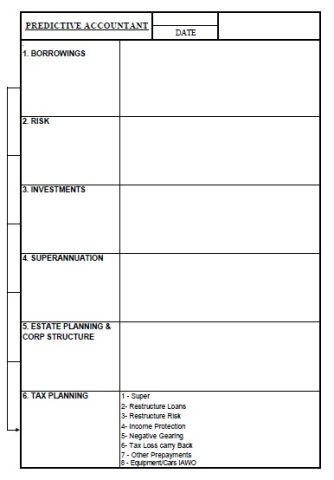

We have designed our “Predictive Accountant” system intended to be a concise, simple and easy to adopt structured approach to Tax and Business Planning.

Rather than focus on the history of a Business or Investor we focus on the future and help you identify and achieve outstanding Tax, Protection and Financial outcomes.

The process includes a forward- looking meeting long before any financial year end.

It is often said that Death and Taxes are the two certainties in life. “The Predictive Accountant” process certainly directs attention to at least the following areas that drive Financial and Tax outcomes:-

- Structure of both Business and Personal Borrowings.

- Corporate Structure and Estate Planning/Your Will/Inter-generational Wealth transfer.

- Structure of Personal Risk Insurances including Life Insurance, TPD, Trauma, Income Protection, Partnership & Key man insurance.

- Investment Structure for all asset classes.

- Retirement Planning and access to Tax concessions in Super.

- Tax Concessions for Equipment and Motor Vehicles/Instant Asset write offs.

See the planner information gathering below.

Please arrange an appointment to discover how this works in practice.